Develop Management Information Systems Around Proven Profit Strategies

May

3

Written by:

Ted See

5/3/2011 8:34 PM

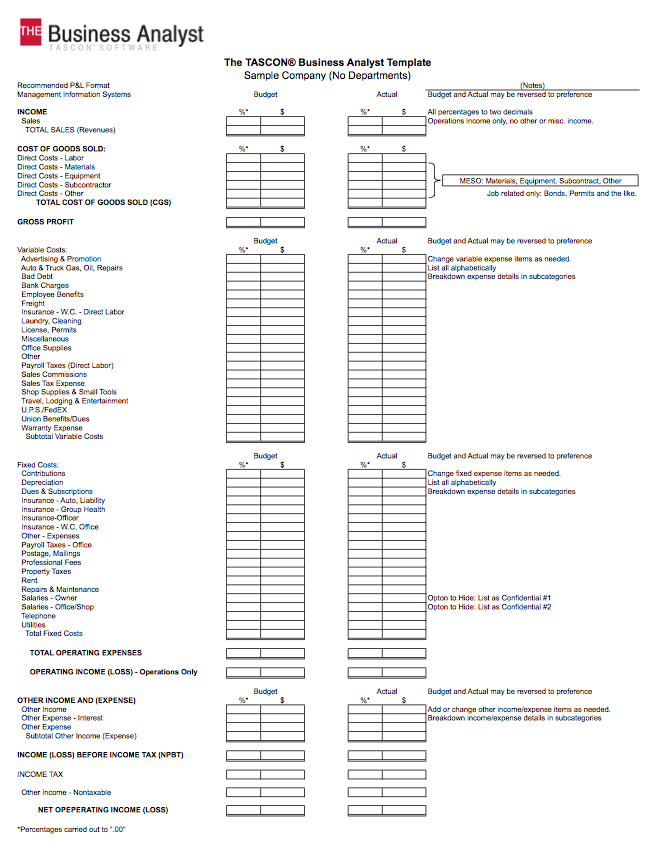

The chances are that your company’s income statement is currently formatted in exactly the same way as one of the income statement “templates” that came with your existing accounting software. DON’T USE THEM! These “templates” are usually designed to follow GAAP (Generally Accepted Accounting Practices) but are typically not designed for proper management information systems (MIS). I want to suggest that you consider formatting your company’s income statement and budgets in the same way that is found within The TASCON® Business Analyst SaaS (www.TheBusinessAnalyst.com). The reason is simple, it utilizes powerful proven and successful business profit strategies that if used, always lead to profit increases.

One of the key strategies that we will discuss evolves around the fact that different expense items fall within different expense categories and the expenses in each category will react in a similar way in relation to the sales income. Using this fact, let’s breakdown the income statement and format it one category at a time.

Income:

List only the income from “operations” in this area. Do not list “Other Income”. This will assure that most industry standard comparisons that may be found and used later in the budget process will be an “apples to apples” comparison by using the same income base. If your company has more than one profit center (department/division), each profit center should be tracked as an individual line item and all line items should be totaled to show the total operating income.

Cost of Goods Sold (Direct Costs):

List only five category items within the area of direct costs. Direct Labor, Direct Materials, Direct Equipment, Direct Subcontractor, Direct Other (Labor and MESO). If your company has more than one profit center (department/division), each profit center should be tracked as an individual line item under each category with subtotals for each category. Most GAAP formatting includes items additional to these such as: Direct Labor Payroll Tax, Union Dues, etc. The reason that we don’t want to list these types of items here is because of the negative effect that it would have on our burden rate calculations. Job costing for any type of business depends upon having the ability to accurately estimate the true “hard” costs of your job, product or service. If the estimator isn’t familiar with the additional “soft” costs from the expenses like direct labor payroll taxes, union dues, etc., it is almost impossible to estimate accurately. If we only use the five key categories listed above there is much more of a chance of maintaining accuracy in the beginning of the full estimating process. The TASCON® Business Analyst uses the dual overhead rate method of job costing that takes into consideration the ratio of the company’s direct labor to MESO (MESO/Labor) and incorporates it with an algorithm to create the most accurate job costing method ever developed. This relationship allows the burden rate to be split between both the direct labor and MESO. Formatting the direct costs in this way facilitates the calculation process. All other variable expense items that may have been listed in this category will be placed in the variable cost category and considered in the final burden factors. Note that all direct cost category expenses are variable costs that “follow” the sales dollar and increase or decrease proportional to the sales volume.

Variable Costs:

List all of the other variable costs in this single category. You will find if you list all of your variable costs alphabetically, your eye will easily find any subject line item when needed. With the addition of the “Variable Cost” category we now have two variable cost sections, the “Cost of Goods” Section and the “Variable Costs” section. All variable costs are initially managed in the same way. To control them, you will first set a control standard (budget) as a percentage of sales volume for each line item. As you list your budget standard next to your actual monthly performance you will easily be able to compare the percentage variance of each line item to identify problem areas.

Fixed Costs:

Next you will list all of the fixed costs in this single category. You will find that if you list all of your fixed costs alphabetically, your eye will easily find any subject line item when needed. Fixed costs are managed differently than the variable costs. Fixed costs are tracked and managed by comparing the actual dollar amount incurred to the actual dollar amount of the budget standard. The percentage that a fixed cost line item is to the total sales will vary with sales but is not a cause for alarm as it would be had it been a variance cost item. Grouping all fixed costs in their own category also provides the added advantage of easily calculating the fixed costs category percentage of sales. Knowing this percentage will aid us in evaluating breakeven points, bid strategies and marketing decisions. As an example, if we know when we will be reaching our breakeven point we have the option of reducing our price by the same percentage as our fixed cost category and still make our full budgeted profit.

Other Income (Expense):

Finally, list all other income and expense items that do not have anything to do with the operations income or expenses of the business. These income and expense items are typically considered a variable cost and would be tracked and managed like the other variable cost items. To control them, you will first set a control standard (budget) as a percentage of sales for each line item and compare the standard to the actual performance. The recommended basis format for an income statement is very simple and could even be considered very “elementary”. You will find a copy of the recommended income statement template in the attached PDF file below.

IncomeStmt-Format.pdf

IncomeStmt-Format.pdf

Copyright ©2017 Ted See